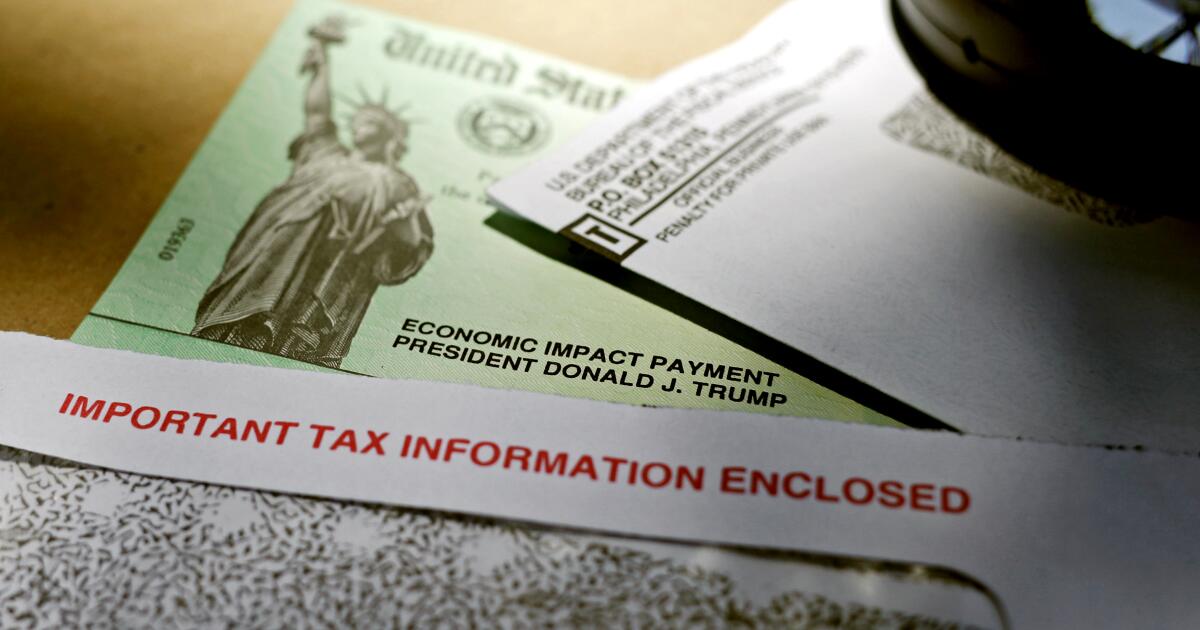

IRS to Distribute Over $2 Billion in Stimulus Payments to Eligible Americans

Background

As part of the COVID-19 relief bill, the Internal Revenue Service (IRS) distributed stimulus payments of up to $1,400 to eligible Americans in 2021. The payments were designed to support individuals and families affected by the pandemic.

New Developments

In a recent announcement, the IRS revealed that an internal review has shown that a significant number of Americans never received their stimulus payments. This is due to the fact that the space for recovery rebate credit was left blank on their 2021 tax returns.

Eligibility and Payment Amounts

Those who qualified for the stimulus payments but did not receive them can now expect to receive up to $1,400 from the federal government. The payments are automatic and do not require filing an amended return.

IRS Commissioner’s Statement

"We’re committed to going the extra mile for taxpayers," said IRS Commissioner Danny Werfel. "By making these payments automatic, we can minimize headaches and get this money to eligible taxpayers quickly."

Eligibility Criteria

To be eligible for the stimulus payments, individuals and households must have had an adjusted gross income (AGI) of:

- Less than $75,000 per year (individuals)

- Under $150,000 as a household (families)

Timeline

The payments are expected to be received by late January 2025, at the latest.

Frequently Asked Questions

Q: Who is eligible for the stimulus payments?

A: Individuals and households with an adjusted gross income (AGI) of less than $75,000 per year (individuals) or under $150,000 as a household (families).

Q: How much can I expect to receive?

A: Up to $1,400.

Q: Do I need to file an amended return to receive the payment?

A: No, the payment is automatic and does not require filing an amended return.

Q: When can I expect to receive the payment?

A: By late January 2025, at the latest.